| This post contains references to products from one or more of our advertisers or for which we receive a referral bonus. We may receive compensation when you click on links to those products. Referral, Affiliate, and Advertising Policy |

In The Starter SeriesIntroduction to Travel Hacking DisneyCredit Cards, Credit Scores, and Credit Concerns The Basics of Points and Miles Signup Bonuses and How to Earn Them Don't Panic Over Annual Fees Some Rules You Need To Know Your First Step To Travel Hacking |

One of the best ways (if not the best way) to accumulate huge amounts of points and miles is through signup bonuses. Virtually every plan for flying somewhere for free on this site or anywhere else is going to rely on one or more signup bonuses. These include:

In this post, we review the basics of signup bonuses before discussing how to get them. The second part will include a brief discussion of "manufactured spending" and how we avoid using it. Finally, we close with how many points you can realistically earn with signup bonuses.

Part 1. A Step-by-Step Guide to Signup Bonuses

By far, signup bonuses are the most accessible route for most of us to earn huge amounts of points and miles. Here's how a signup bonus works.

Step 1. A Credit Card Company Makes an Offer

The first step in getting a signup bonus is a credit card company making an offer.

Where to Find Signup Bonus Offers

For starters, credit card companies make offers in a variety of places. Here are just a few places you might find a signup bonus offer:

Publicly available on the credit card company's website

A special "offers" page on your account once you login to the website

At a physical bank location

In the mail to you

Referral links / advertising at other websites (such as our referral page)

A banner on any number of websites you visit

There are lots of ways that credit card companies work to put offers right in front of you. But you probably don't want to just search all these locations in search of the best deals. Here are some locations where you can find some of the best currently available offers:

Finally, while we don't rank currently available offers, we regularly link to them in our post on how to do Walt Disney World for Free, and our referral page has all our links. Using our links when you decide to apply is a nice way to support us, but we always suggest reading reviews of cards (including ours) and checking for the best available offer before applying.

What Do Signup Bonus Offers Look Like

For an online offer, a signup bonus offer literally looks something like this:

A Chase Sapphire Reserve signup bonus offer

Beyond actual appearance, most signup offers take the same form:

Earn X points for spending $Y within Z months/days of account opening.

Some signup bonuses require $5,000 spending in 3 months. Some require just a single purchase in 90 days. Some offer 100,000 miles. Some offer $150 cash back for $500 spending. More complicated bonuses will offer something like 50,000 points for spending $3,000 in 3 months and then another 50,000 points for spending $10,000 your first year.

Make Sure You Qualify For the Signup Bonus

There's no way to be 100% sure you qualify for a signup bonus other than to read the fine print behind it. Our list of rules to know covers some, but not all, of the rules credit card companies will use to deny your signup bonus (or to deny your card application).

Why Do Credit Card Companies Offer Huge Signup Bonuses

This is important to understand because it is the most important reason why "travel hacking" is even possible. We discussed these points back in the first starter post, but they bear repeating for anyone arriving at this post fresh. Credit card companies offer huge signup bonuses for the following reasons (among others, we're sure):

To get you to sign up for a card with an annual fee. Most signup bonuses on annual fee cards are recovered by the company in two to five years. We discuss how to evaluate annual fees in another starter post.

To get you to run up a huge balance and then pay interest. En route to getting the signup bonus, the company expects you to run up a balance. If you can't pay it down immediately, you pay interest and they come out on top. Don't pursue signup bonuses if you carry a credit card balance or cannot pay off the amount required for the bonus.

Some people don't get the signup bonus. Some percentage of people who try to get a signup bonus forget to spend the required amount in the required time and don't get the bonus.

Signup bonuses are great for "free" marketing. We haven't stopped talking about the Chase Sapphire Reserve since it debuted with a 100,000 point offer. Arguably, that card and bonus offer was what prompted us to start traveling the world and travel blogging. Even at 50,000 points, we still talk about it all the time. If it didn't have a signup bonus, we'd probably direct more people to the Citi Prestige.

No one knows what the future holds. Even if a credit card company loses money in the short run on a signup bonus, ten years from now a cardholder might hit a rough patch and need to put a big expense on a card. That big expense will come with big interest. Just having a space in your wallet is worth something to a credit card company.

There are more reasons, to be sure, but these are some of the big ones. The big takeaway from this list is to be on the right side of all these! Product change credit cards when the annual fee isn't worth it. Never carry a balance. Always get your signup bonus. Make sure you know how a card works for you, not just everyone else. And be prepared!

Step 2. Apply for the Card Through the Offer and Get Approved

This simple step actually conceals a few complicated layers.

Use The Link With The Offer You're Targeting

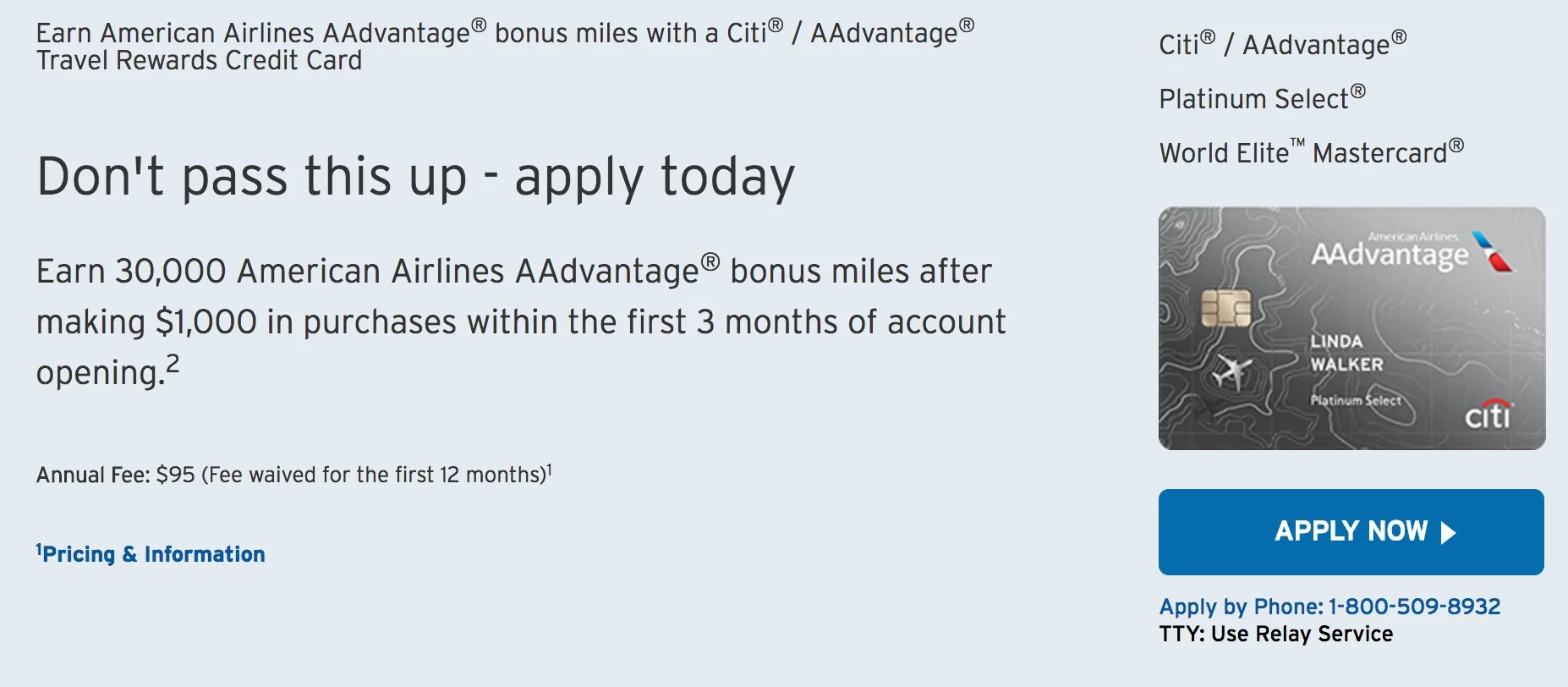

This is simple, but important. You need to use a link or application that clearly advertises the offer you're pursuing. Many cards have multiple public offers at a time, and sometimes one link will have a much better offer (even double) than another. Here's an example of two Citi AAdvantage offers that were available at the same time:

This public Citi AAdvantage link offers 60,000 bonus miles

This public Citi AAdvantage link only offers 30,000 miles (but for less spend)

Take screenshots showing what link you clicked and what offer it came with. Similarly, if you mail in an application, keep copies of the documents you used.

Getting Approved & Reconsideration

Sometimes you'll be approved for a card instantaneously online. Other times you'll be told to wait, and the card might pop up in your online account in a matter or hours or days. Still other times you'll have to call in to provide more information before getting approved.

Just because the credit card company declines your application on your first try doesn't mean the fight is over. That said, this post isn't about how to get around getting turned down for a card. If you're interested in researching that further, you'll want to Google "[credit card] reconsideration." We've done several reconsideration calls. Some worked, some didn't. We once were told to call for a chat about a pending application, forgot, and had the bank just approve it anyways (we don't recommend that).

Step 3. Spend the required amount in the required timeframe

You'll need to hit the "minimum spend" that the credit card company is asking for in the required timeframe. Part 2 of this post covers what to spend (and how) in order to meet the minimum spend. In this section, we just want to make a few more fundamental points.

Always Spend Over The Minimum Spend

We always aim for about 10% over the minimum spend to be sure we're protected in case of any errant refunds or cancelled charges. As finicky budgeters, we can tell you we've seen charges disappear from our statements for over a week before reappearing. Don't let this be the difference between you and a huge bonus.

Count From The Day You Applied

Credit card companies use different measures and different terminology to determine exactly when your spending must be done. We always count from the day we applied and get our spending done before the required timeframe elapses from that date. In most cases it's actually the day you're approved that matters, but these days are rarely more than a few days apart, and we'd rather be safe than sorry.

Annual Fees Don't Count

Sorry, that $450 annual fee from the Chase Sapphire Reserve doesn't get you any closer to a signup bonus. Remember that if you just look at your bills to see how much you've spent, you need to subtract the annual fee for the purposes of hitting minimum spend.

Points Can Be Taken Away

Credit card companies can and will take points away if they think you're cheating them. This is particularly a problem when you make a big purchase and return it after you've gotten the points. With smaller amounts it's less likely to be a problem, but either way you should be careful.

Step 4. The bonus posts to your account

Signup bonuses take a variety of times to post to your account. Some will show up as "pending" immediately. Some will post when your statement closes. Some will post after 2-3 billing cycles go by.

Since it doesn't always happen immediately, if you spend just over the minimum spend, you might be stuck worrying whether the bank is going to deny you the offer because you clicked the wrong link, or because some of your spend didn't count. Or maybe you returned an item and forgot that it counted against your minimum spend (it does).

For a while, we just waited on two pending signup bonuses from American Express.

Always spend comfortably more than the minimum spend. If your bonus hasn't posted after a full billing cycle has gone by, call the issuer and see what's up.

And that's it! Once your bonus posts, the points are yours!

Part 2. How to Hit Minimum Spend Without Manufacturing Spending

Okay, so you've got the process down, but what about actually spending the required amount? Let's talk more about that now.

Manufactured Spending, Briefly

One way some travel hackers earn signup bonuses is with "manufactured spending." This activity gets its name from the fact that you are trying to get a spending bonus without actually losing any money. You're just "manufacturing" the spending for the purposes of the bonus.

Manufactured spending is related to credit card churning, the practice of opening cards, earning signup bonuses, closing cards, and reopening card as a high rate.

What is manufactured spending?

Here's a simple example of manufactured spending.

You get a new credit card with an offer of 50,000 points for $3,000 spending in 3 months.

You buy $3,000 of gift cards with it to get the signup bonus.

You sell the gift cards on eBay.

In this example, you've earned a signup bonus for $3,000 spend, but you've really only spent the amount you lost on the gift cards (including eBay fees and Paypal fees). This is a really bad manufacture spending strategy, but it's a simple example of the concept.

Should I Manufacture Spending?

We don't manufacture spend (even though Google seems to refer a lot of people to this post for the search "manufacture spending"). We're not philosophically opposed to it, but it requires a lot of time, energy, and organization that we don't want to commit to it. Some methods are legal, some are not, some are in a grey area. If you want to know more, there is a ton available on other sites about it.

How we hit minimum spend limits

There's very little trickery involved here. For the most part, we hit minimum spend by being organized and putting our expenses on the right cards at the right times. There are a few tricks we employ occasionally, though, so read on.

1. Be Organized and Know Your Spending

Let's say that as a couple, we know that if nothing else, we will put about $400 per week onto credit cards just in our day-to-day spending. This is money we spend on things like groceries, dining, new clothes, Starbucks, and transit.

In three months (the usual window for a minimum spend) that's about $4,800 of spending. If we can get that onto a single account (either by using a single card or through one of us being an authorized user), we'll easily hit any spending requirement short of $5,000 in three months.

They key here is organization:

You have to use the card you're trying to get the bonus on.

You have to change your automatic (e.g. your Starbucks reload) and online (e.g. your Amazon account) payments to that card.

You have to know how you're going to hit the minimum if your spending slows down.

You don't want to be scrambling with one week to go to spend a bunch of money. But what if you need a little boost because you're working on multiple signup bonuses, or because you can't quite hit one with your regular spending. Well, there are some simple tricks you can try.

2. Buy Gift Cards to Places You'll Go Anyways

Unlike manufactured spending, you're not selling the gift cards you buy this way. You're going to use them. Let's say you spend $100 at Starbucks every month. In three months of trying to hit the minimum spend you'll only spend $300 at Starbucks. But if you buy a $500 gift card to use for the next five months, you're just consolidating eight months of spending into three months. It's important to understand three things about this option.

First, only buy gift cards to your regular spots. If you buy gift cards to places where you have to spend more money than you otherwise would, you're wasting money. You want to buy gift cards for places you spend money all the time anyways. Think grocery stores, Starbucks, and maybe some discount Disney gift cards. Don't buy $1,000 of gift cards to the movies and then just start going to the movies more.

Second, this doesn't work as a long-term strategy. Once you've bought gift cards, you have to actually spend them. Returning to the Starbucks example, if you started earning your next signup bonus right away, you won't have that regular spending from Starbucks to put on the card because you'd be spending the gift card.

Third, like all of these strategies, you shouldn't do this if you can't pay off the balance on your card. Once you start paying interest, you're losing.

3. Pay Your Mortgage or Rent with a Credit Card

In many cases, you may be able to pay your mortgage or rent with a credit card. If your particular bank or landlord doesn't offer this option, you should look into Plastiq, which, for a 2.5% fee, will cut a check to your bank or landlord and bill your credit card. Keep in mind that the 2.5% fee means that using Plastiq to generate points is a bad idea unless you're going for a signup bonus. Even when going for a signup bonus, it isn't ideal.

Conversely, if your landlord doesn't accept Plastiq but charges 5% for credit card, it might still be worth it to pay with a card in order to hit your minimum spend. If your rent is $1,000, then 3 months rent on a card would allow you to hit a $3,000 minimum spend. At a 5% fee, you'd spend $150 in fees, which is far less than the value of most 50,000 point bonuses.

That said, these fees eat into your bonuses big time. We used this option a few times to earn a massive amount of points in a short time (we're talking 1,000,000, not 100,000), but we don't think casual travelers should resort to them.

4. Pay Your Taxes with a Credit Card

Like paying your mortgage or your rent, there is usually going to be a fee that comes with paying your taxes by credit card. Exactly how you do this may depend on to whom you owe taxes and what filing service you use, but like paying your rent or mortgage, this is a big required expense, and using it to hit a minimum spend could make the fee worth it.

5. Prepay your Bills

Frugal Travel Guy has a post on how you can prepay your bills to hit minimum spends. Like paying for gift cards, this method is tricky because it will reduce your ability to hit minimum spends going forward. That said, if you're really all about a specific minimum spend (and you should always be worried most about the ones you're actively working on), this could be a good option.

Part 3. How Many Points Can You Earn With Signup Bonuses

The higher your spending power (that is, the amount of money you can spend in a given time), the more opportunities you'll have to earn signup bonuses. This is why people increase their spending power through manufactured spending. But if you're not going to manufacture spending, it's reasonable to wonder what the limits of your earning power are. Keep in mind here that not all points are created equally. We're going to be talking mostly about points that are worth between 1 and 2 cents each. Let's compare some households to see how many points they can earn.

Note: Single Purchase Signup Bonuses

There are usually a few offers out there for bonuses triggered by a single purchase. One great limited time offer as of this writing is the Barclay AAdvantage Aviator Red card which offers 60,000 AAdvantage Miles for a single purchase. We're not going to include these cards in our below calculations because they can really skew the numbers and they come and go more sporadically than longstanding, high-quality, high-spend bonuses. But there is no reason to ignore these cards. There's no gimmicks involved. If you need 60,000 AAdvantage miles, go grab them! We'll be waiting for you.

Household 1 - Spends Up to $12,000 Annually On Credit Cards

Most signup bonuses require between $2,000 and $5,000 spending. Finding six good offers at $2,000 would be a bit challenging. Household 1 is probably going to be able to earn three or four high-quality signup bonuses with 50,000 points each. For example, if there are two adults in the household, they could get two Chase Sapphire Preferred cards and one Chase Ink Business Preferred, earning 180,000 points along the way. Household 1 will also only rarely run afoul of Chase's 5/24 rule. By spacing out their applications properly, they can repeat this process every year.

Household 2 - Spends $36,000 Annually on Credit Cards

Household 2 can earn between nine and 12 high-quality bonuses, and can probably easily get up to 15 to 17 with some targeted offers (like when we were offered 50,000 Membership Rewards points for only $2,000 spending on our American Express Premier Rewards Gold card). They're probably looking at a rough ceiling of 600,000 points. Things will start to get tricky for them, though, as finding 15 good offers in a year is no small feat.

Household 3 - Spends More than $36,000 Annually On Credit Cards

There are only so many credit cards out there, and more importantly there are only so many quality cards out there. At their kindest, credit card companies allow you to earn signup bonuses for cards roughly every two years. This means that over two years, someone who opened 20 cards a year would need a set of 40 cards to rotate between. There just aren't 40 good offers in two years. There probably aren't 20 good offers in two years. Of course, if your household has two adults, your options open a little, as you can both apply for the same cards. 1,000,000 points is in sight for this household, but that doesn't mean it's advisable.

Our Recent Experience (Including Single Purchase Bonuses)

En route to earning 1,000,000 points in one year, we earned 14 signup bonuses that required $34,003 spending and generated 775,000 points, or 22 points per dollar. How did we get such value? Some of our more generous bonuses included:

35,000 points for $1,000 spend on an Amex Everyday

50,000 points for $2,000 spend on American Express Premier Rewards Gold (twice)

60,000 LifeMiles for $1 spend on an Avianca card

40,000 AAdvantage miles for $1 spend on the Barclay Aviator Mastercard (twice)

But here are some notes about this endeavor:

We both crossed Chase 5/24 and won't be able to get Chase cards for about 18 months

We earned four once-in-a-lifetime bonuses from American Express.

We used two great single purchase bonuses in the LifeMiles and Barclay Aviator cards

We were empowered by having two creditworthy household members who could open new cards

We were able to put these points to use as part of 15 months of world travel (that is, points that were useful for us might not be useful for you)

This is all to say that most readers should not base their goals off our experiences. Rather, we'd probably advise readers to act like Household 1. Put together a simple plan for earning 100,000 to 200,000 points and use that for an annual vacation.

What's Next?

So you signed up for the Chase Sapphire Reserve and earned the 50,000 point signup bonus. Great job! And then a year from now, you're hit with a $450 annual fee. That's $900 over two years. All of a sudden those 50,000 points aren't looking so worth it, right? Wrong! Let's move on to annual fees...