It’s unsurprising that as frequent Disney vacationers, we’re holders of the Chase Disney Rewards Visa. But there are actually several other credit cards that we love just as much (more, actually) when it comes to preparing for and saving big on our Disney vacations. In this post, we go through the credit cards we think Disney travelers need to be considering, and how they can fit into your Disney planning.

Time is money. But so are perks and points…and money…

The Chase Disney Visa - Good for the perks

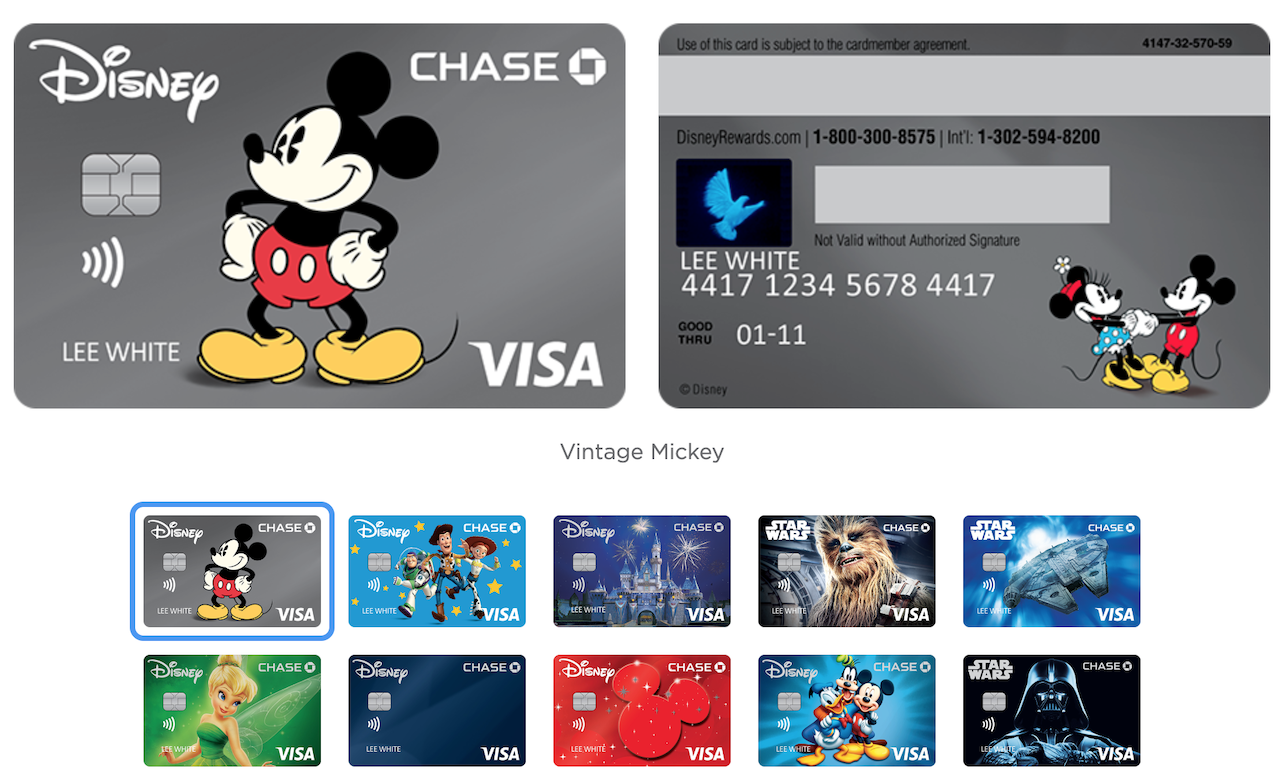

We’ll start with the Chase Disney Visa cards because they’re the most obvious cards that Disney travelers will consider.

Basics about the Chase Disney Visa

Annual Fee - $0 (standard) / $49 (Premier)

Issuing Bank - Chase

Rewards Program - Disney dollars (1% to 5% back, category and card dependent)

Notable Disney-Related Perks - Discounts on Disney merchandise and dining including at Disney theme parks; special room / vacation package offers, special Disney character greetings

Our review of the Chase Disney Visa card is here.

Copyright Disney, Chase

The Chase Disney Visa has some great perks. There are occasional room discount offers and dedicated character stops, but 10% discounts on select Disney World / Disneyland dining and merchandise expenses are where you’re going to find the most value. (Annual passholders who already get these discounts might not find much value here. Read more about Disney World annual passes and Disneyland annual passes.)

It is a good card if you can afford your trip but don’t want to be hit with the big bill all at once (0% interest for 6 months) or if you’re a big spender on dining or merchandise at the resorts. The Chase Disney Visa cards also give you access to the Disney Rewards program, which allows you to earn Disney Rewards dollars you can spend on Disney vacations. However, because of their poor earnings rates (1% back on almost all categories), these aren’t likely to be good cards for everyday spend.

Best of all, the standard version of the card has $0 annual fee. The Disney Premier Visa Card has a $49 annual fee. If you’re hesitant about getting a card with a high annual fee and you’re looking for a good option for you wallet before your Disney vacation, the Chase Disney credit cards are good options.

Marriott Branded Cards - Best For Earning Free Nights at Swan & Dolphin

Both American Express and Chase issue cards that earn you Marriott Bonvoy points and free nights at Marriott hotels. There are a variety of card options with a variety of fees and perks:

What’s important about these cards is they earn—including via sizable signup bonuses—Marriott Bonvoy points and free nights at Marriott hotels. The Walt Disney World Swan, Dolphin, and Swan Reserve are Marriott hotels. Not only that, these hotels get Early Theme Park Entry and Extended Evening Hours, making them some of the most perk-heavy non-Disney hotels around.

Disney hotels are harder than ever to book with points, but the Swan and Dolphin get you important perks even without the Disney branding. Read more about Booking the Swan and Dolphin with Marriott points.

The additional perks (the Amex Marriott Bonvoy Brilliant card comes with Marriott Platinum status, for example) might be of some worth if you’re considering stays at these hotels, too.

Amex Platinum and Gold - Best For Luxury Hotels Near Disney World

Basics About the Amex Platinum and Gold

Annual Fee - $250 (Gold) / $695 (Platinum)

Issuing Bank - American Express

Rewards Program - Membership Rewards

Notable Disney-Related Perks - Access to The Hotel Collection / Fine Hotels + Resorts bookings for certain hotels near Disney World

Amex Platinum Homepage

Amex Gold Homepage

For starters, you shouldn’t be signing up for the Amex Gold or Platinum just because of what you read in this post. These cards come with high annual fees ($250 for the Gold, $695 for the Platinum) that can only be justified if you’re going to get a lot of value out of their perks or points. We talk a little bit more about the Amex Platinum on our sister site. (Notably, the Amex Platinum has a $240 entertainment credit that can be used for Disney Plus.)

The Amex Platinum and Gold give you access to special hotel programs that can be used to enhance your stay at select hotels near Walt Disney World. The Amex Gold gives you access to “The Hotel Collection.” Bookings made through The Hotel Collection come with a $100 hotel experience credit and access to room upgrades, when available. The Walt Disney World Swan, Dolphin, and Swan Reserve are some of the hotels participating in The Hotel Collection.

The Amex Platinum gives you access to The Hotel Collection and “Fine Hotels + Resorts.” Fine Hotels + Resorts bookings come with a larger set of benefits:

Room upgrade upon arrival, when available

Daily breakfast for two people

Guaranteed 4pm late check-out

Noon check-in, when available

Complimentary WI-FI

Experience credit, such as a spa or food and beverage credit

Amex Platinum (personal version) cardholders also get a $200 statement credit once a year for Fine Hotels + Resorts bookings. Some hotels that participate in Fine Hotels + Resorts are: Ritz Carlton Orlando, Grande Lakes; Four Seasons Orlando at Walt Disney World Resort; Waldorf Astoria Orlando; and Universal’s Portofino Bay Resort. We also talk more about the Fine Hotels + Resorts program on our sister site.

Chase Sapphire Preferred & Reserve - Good For All Travelers

Annual Fee - $95 (Preferred) / $550 (Reserve)

Issuing Bank - Chase

Rewards Program - Chase Ultimate Rewards

Notable Disney-Related Perks - None

Chase Sapphire Preferred Homepage

Chase Sapphire Reserve Homepage

This is honestly sort of a catchall. If you’re brand new to using credit cards points and miles, then I have to tell you about the the Chase Sapphire Preferred and Reserve cards. If you’re not new, then you probably already know about these cards (and you can probably be done with this post).

The Chase Sapphire Preferred and Reserve are the main travel credit cards issues by Chase. They earn Chase Ultimate Rewards points, including higher rates for travel and dining purchases. These points are then good for at least 1 cent in the form of a statement credit.

Unfortunately, the points are worth more when you use them to book travel via the Chase travel portal, which in recent times has not had the Disney hotels, or the Swan and Dolphin, or most of the other hotels you’d want to book for a Disney World stay. You can also get good value by transferring them to partner airlines or hotels, but it’s not easy to find real value there for Disney vacations, either.

This means that while you’ll often want to charge your hotel / ticket expenses to your Chase Sapphire Preferred or Reserve, you’ll have to have another plan for redeeming the points. I almost always charge my personal stays to my Chase Sapphire Reserve, and we most recently used a lot of our points to book a flight in Emirates A380 business class. If your travel is mostly Disney focused, you might have to go out of your way to get good value from your Chase Ultimate Rewards points.

Finally, you might wonder whether to choose the Chase Sapphire Reserve or Preferred. This is mostly a math problem. The Sapphire Reserve comes with a $550 annual fee easily partially offset by a $300 travel credit, so $250 out of pocket. The Sapphire Preferred comes with a $95 annual fee not-so-easily partially offset by a $50 credit for hotels booked via Chase, so let’s say $45 out of pocket.

Whether you can justify the additional $205 for the Sapphire Reserve is a matter of personal circumstance. The Sapphire Reserve has a better Instacart perk, for now. It earns higher rates on travel, particularly travel booked through Chase. Going through all these calculations is a better task for Excel than this post.

Other Contenders

Let’s fill out this list with some cards that are maybe less powerful or well-rounded than our choices, but which you need to know about regardless.

Citi Premier

The Citi Premier is Citi’s top travel rewards credit card, with an annual fee of $95. As of this update, the new Citi Travel Portal does list some Disney-operated hotels, along with the Swan & Dolphin hotels. This makes it the best credit card portal for booking Disney hotel stays. That said, you only get 1 cent per point redeeming Citi Thank You points this way. Since Chase Ultimate Rewards points can be used for 1 cent each as a statement credit, there’s no advantage for Citi here.

2% Cash Back Cards

Both the Citi Double Cash and the Fidelity Rewards Visa Signature Card earn 2% cash back on all purchases. If you’re looking for simplicity and an acceptable return on your spending, these are good to consider.