| This post contains references to products from one or more of our advertisers or for which we receive a referral bonus. We may receive compensation when you click on links to those products. Referral, Affiliate, and Advertising Policy |

The Chase Sapphire Reserve burst onto the scene in 2016 with it's 100,000 points signup bonus, and when it did we jumped on it (twice, actually)! We'll give an overview of what this card offers, why it matters to you (especially Disney travelers), and our thoughts on whether it deserves a space in your wallet.

How does the Chase Sapphire Reserve look this year?

The Basics

The Chase Sapphire Reserve is a Visa Infinite card that earns Chase Ultimate Rewards points. You earn 1x points on most purchases and 3x points on restaurants and travel. At Disney World, you can charge everything to your Magic Band, and thus to your room, and it will code as "travel" when you put the bill on your Chase Sapphire Reserve.

The card has a whopping $450 annual fee, and authorized users cost $75 each. However, the card also has a generous, easy to us $300 travel credit. We’ve used the credit for discount Disney ticket purchases through Undercover Tourist before. Since this credit automatically posts for anything that codes as travel, including Uber, the “out of pocket” cost for the card is usually only $150. The signup bonus (as of Oct. 8, 2018) for the card is 50,000 points for spending $4,000 in 3 months.

The Chase Travel Portal

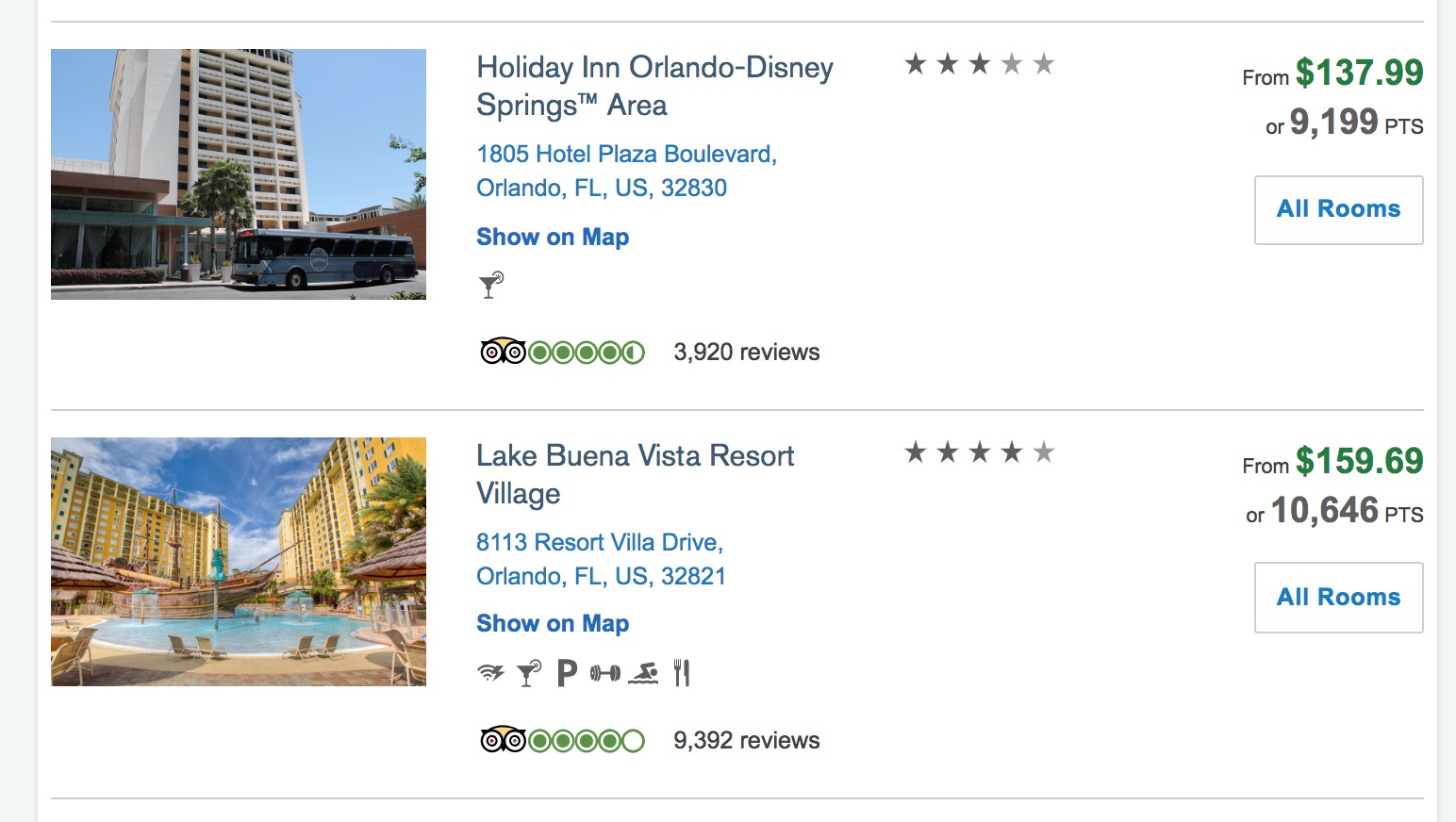

The Chase Sapphire Reserve gets you access to the Chase Travel Portal and the ability to spend points at a rate of 1.5 cents per point in that portal. That means when booking hotels, flights, and some activities through the portal (sort of like you would on Expedia or Hotels.com), you'll get to use your points for 1.5 cents each.

With several hotels near Walt Disney World available in the port, the 50,000 signup bonus is good for $750 toward a Disney vacation. Moreover, with the right combination of cards, you can earn 2.25 cents per dollar spent.

The Chase Ultimate Rewards Program

If you're not spending your points directly on flights or hotels, they can be transferred to a wide variety of Chase partners, including United and Marriott. As Marriott points can be used to book the Walt Disney World Swan & Dolphin, Chase Sapphire cards can be a part of your strategy for booking Walt Disney World with points.

Chase Ultimate Rewards points are some of the most valuable points around because of the number of transfer partners and the access you'll get to booking premium cabin (business class, first class) international awards using the points you've earned. If international Disney is in your future, you need to consider this card, or the Chase Sapphire Preferred, now.

The Perks That Matter Most To You

The Chase Sapphire Reserve has a whole host of perks, but they aren't all relevant to everyone. Here, we're going to focus on the perks that are most important to family and Disney travelers.

Priority Pass Select

The Chase Sapphire Reserve comes with Priority Pass Select, a lounge membership that gets you (and your travel party) access to lounges at a wide array of airports, including (relevant for Disney travelers) at Orlando - MCO, the international terminal at Los Angeles - LAX, Paris - CDG, Shanghai - PVG, Hong Kong - HKG, and Tokyo - NRT.

Priority Pass gets you access to lounges for free drinks, snacks, and sometimes even showers!

For families this perk can be huge because you escape the chaos of the airport and you and the family can refresh with snacks, drinks, and sometimes full meals and showers. This perk is worth about $300 per year, although the "Select" membership is not actually available for purchase.

The Luxury Hotel & Resort Collection

Chase Sapphire Reserve cardholders have access to special perks at hotels in Chase's "The Luxury Hotel & Resort Collection" program. Near Disney World, this includes (with indicated perks):

Hyatt Regency Grand Cypress (daily breakfast for two)

Hyatt Regency Orlando (daily breakfast for all, $75 resort credit)

Waldorf Astoria Orlando (daily breakfast for two, $100 resort credit)

If you're a frequent visitor to any of these hotels, of if you have trips to them in the future, you could certainly get good value out of this perk.

Global Entry / TSA PreCheck Reimbursement

You're entitled to one $100 reimbursement for signing up for Global Entry or TSA PreCheck. We highly recommend Global Entry, it has saved us hours, and we're not exaggerating, on trips arriving in the U.S. Global Entry comes with TSA PreCheck, which you probably know is a good way to skip security lines. You can use this benefit once every four years (the memberships last five years).

Travel Protection & Insurance

The nitty gritty of this topic could fill more than one post on its own, but the Chase Sapphire Reserve offers an excellent array of protections in case your flight is delayed or cancelled, your bags are lost, or something happens to you while traveling. The Points Guy has a good rundown of these (and all the other) perks.

Car Rental Perks

We don't know much about this since we barely ever rent cars, but as a Visa Infinite card, the Chase Sapphire Reserve has access to certain perks at Avis, National, and Silvercar rental car companies. Presumably these come in a combination of discounts and upgrades. We know a lot of people like to drive to their Disney destinations (or rent cars while there), so these perks might be worth considering.

Get This Card If...

There's really no reason to not have either this card or the Chase Sapphire Preferred, which currently (10/08/2018) also offers 50,000 as a signup bonus. We compare the two in a separate post on choosing between the Chase Sapphire Preferred and Chase Sapphire Reserve.

Disney and family travelers especially can get value out of the Priority Pass membership and the Global Entry / TSA PreCheck credit. If you're into rental cars, we suspect you'll find some value in those perks too.

If you're completely new to the wonderful world of points and miles, we really suggest starting with one of these cards. We started with the Chase Sapphire Preferred and haven't looked back.

Skip This Card If...

If you're sure you're not traveling in the next year, it might make sense just to start with the Preferred, especially if you're new to points and miles.

Consider These Alternatives

As we mentioned, the Chase Sapphire Preferred is the most obvious alternative. If you're definitely looking for a premium credit card, we'd also consider the Citi Prestige. The Citi Prestige's "4th Night Free" benefit is the most powerful credit card perk available for Disney travelers (and frequent travelers of any sort). We save hundreds, sometimes thousands, of dollars using that perk every year.